High Conviction Swing Trading

I'm Gustav — a Swedish engineer

and part-time swing trader.

CTO in renewable energy. Trading fits into my life — not the other way around.

Few positions. Heavy sizing. Full transparency.

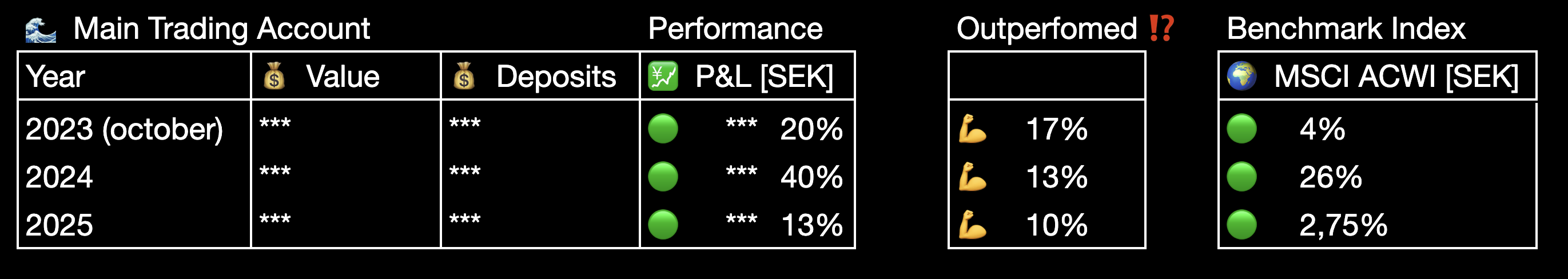

Results — not promises

vs global index

profitable years

(equities, options, crypto)

2025 — 2050

Outperformance benchmarked against MSCI ACWI using identical time periods and capital contributions.

Why this approach is different

Most trading content sells day trading, scalping, and the "quit your job" fantasy. I started trading in 2022 and quickly realized that path fails for the vast majority.

I trade differently. High Conviction Swing Trading is a structured, high-timeframe approach that lets me trade efficiently while balancing a full-time career — backed by real trades, real data, and public accountability.

Get the free Trading Dashboard

The exact Google Sheets template I use every day:

- Track the public 25 Year Trading Experiment

- Manage every active swing trade in real-time

- Calculate position sizes and risk automatically

- Benchmark performance vs the global index

No complicated formulas. No expensive software.

The 25 Year Trading Experiment (2025 — 2050)

Since January 2025 I've been running a public, long-horizon experiment to answer one question:

How it works: monthly contributions, active swing trading vs passive global index, full visibility into drawdowns, volatility, and mistakes. No hiding. Every trader is on their own journey — this is mine, documented in the open.

This isn't about short-term results — it's about whether the process holds up over time. I'm not here to sell you a dream — just sharing what works for me.

Read more about the experiment

Live trades — full transparency

I share entries, stop-losses, and exits live on X — not as signals, but to document my decisions in real time. Wins and losses. No hindsight. No edited charts.

Start reading

Who this is for

- Traders who want trading to fit into their life, not consume it

- People focused on long-term consistency over quick wins

- Those who value discipline over excitement

- Anyone honest enough to benchmark themselves against the market

About

I'm Gustav (Trader Gu) — a Swedish engineer, CTO in renewable energy, and part-time swing trader with multiple years of consistent profitability. I started trading in 2022 and built an approach focused on high-conviction setups, proper risk management, and executing only when the right conditions align.

This site is my trading journal, toolbox, and accountability mechanism. Publishing my process publicly — wins and losses — forces clarity, discipline, and intellectual honesty. I'm not perfect, and I'm still learning. That's the point.

Disclaimer

Nothing on this website constitutes financial advice, investment advice, or a recommendation to buy or sell any security.

- Past performance does not guarantee future results

- All examples reflect my personal trading activity

- Markets change, and strategies can fail

- You are responsible for your own decisions and risk management

This site exists to document a process — not to provide predictions or guarantees.

Connect: X / Twitter · Email · Substack